The future of American hegemony

- Virin Mukherjee

- Nov 19, 2024

- 6 min read

By: Virin Mukherjee; Edited by: Parisa Chatrath

The American hegemony is fragmenting. America’s chokehold over world politics and economy is loosening. States seem to have begun to destabilize this hegemony and “consider alternatives to insulate themselves” from the overarching dependence on the greenback in their finances. De-dollarization, therefore, forms the crux of this economic downturn.

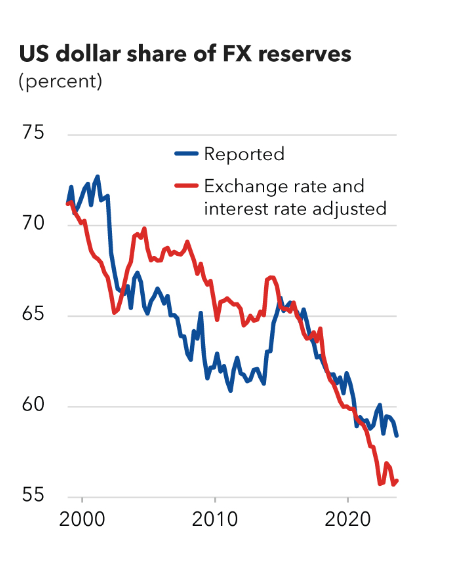

The dollar, known as the reserve currency of the world, has been declining since 2000 in terms of the percentage of total forex reserves. 70% of global forex reserves were held in dollars in 2000, which have dropped to almost 55%.

Source: IMF

Geostrategic shifts in global trade in response to US sanctions, the rise of regional trade blocs, and an overall urge to reduce dependency on the dollar as a shield from sanctions have been major motivators for de-dollarization.

1) De-dollarization in global trade

In light of the Russia-Ukraine conflict, there were major sanctions placed on Russia by the USA which constricted export avenues and increased the cost of operations for Russia. The most significant impact of these sanctions has been on Russia’s oil exports to the West. To maintain revenue, Russia has diverted its energy exports to Asia, forming bilateral agreements with China and India who are willing to engage in non-dollar transactions.

Oil trades in the Chinese Yuan and the Indian Rupee diminish the effect of US sanctions on Russia and strengthen economic ties between these three major powers. Russian oil is now sold in local, Russia-friendly, currencies. In fact, China and Russia have almost fully de-dollarized their economic ties, with 90% of their trade now being undertaken in either the Ruble or the Yuan.

Saudi Arabia, too, has not made any official announcement about renewing the famous Petrodollar deal made 50 years ago, which required all trades of Saudi Arabian oil to take place in dollars. This marks a strong shift away from US economic dominance, as Saudi Arabia will not undertake oil trades only in dollars but also in currencies like Chinese RMB, Euro, or Yen, thus breaking a long-standing bilateral trade agreement.

The Chinese Remnibi as an alternative has also been gaining major traction in international trade. In South America, Brazil, Argentina, and Bolivia have begun majorly using the RMB for their imports and exports. In Asia, countries such as the UAE and South Korea have also started using RMB and issued currency swap agreements with China. Pakistan and Saudi Arabia will make energy transactions through the Yuan, along with Bangladesh, Iran, and Thailand. This reflects a major move to internationalize the Chinese currency.

2) Strategic economic organizations among states -

The rise of regional trade blocs has been a major contributor to de-dollarization. These blocs encourage trade in local currencies, increasing co-dependence and reducing dollar usage among the members. The most prominent among these blocs is BRICS, which an earlier article on the Economic Ashokan has explored deeply. BRICS has been a strong force in mobilizing non-dollar trade and promises sustained economic partnership between member nations. Other blocs, such as the Eurasian Economic Union, Shanghai Cooperation Organization, African Continental Free Trade Area (AfCFTA), and Association of Southeast Asian Nations (ASEAN), have been trying to increase local currency trade. These organizations play an important role in de-dollarization, as they provide platforms where non-US interests are formulated and implemented in the global economy. For example, BRICS was discussing establishing a grain exchange platform because BRICS countries cannot participate in grain price formation to the extent that is proportional to their contribution to the global grain market.

3) Gold as an alternative to the dollar as an avenue of stable value stores

The gold market has been bullish, with a 26.5% increase in the gold price as of 30th September 2024. According to the World Gold Council, this increased drive in gold demand as a safe haven has been due to uncertainty in the dollar and geopolitical tensions in the Middle East.

According to the World Gold Council, gold purchases by central banks had increased 14% y.o.y by October 2023. The declining certainty of the dollar is a major factor underscoring this trend – India, Turkey, and China’s central banks have significantly ramped up their gold purchases. China has been on a gold-buying spree for the last 16 months, and India in particular has significantly increased its pace of gold accumulation, reflecting a geopolitical response to the uncertainty of holding assets in dollars after the onset of the Ukraine conflict.

All of this being said, the dollar is still the major currency held by all central banks to finance imports and the most dominant currency in international transactions - with 88% of all trade still taking place in dollars. However, shifts away from hegemonic currencies are long, gradual processes; the transition from the pound sterling to the dollar took two decades.

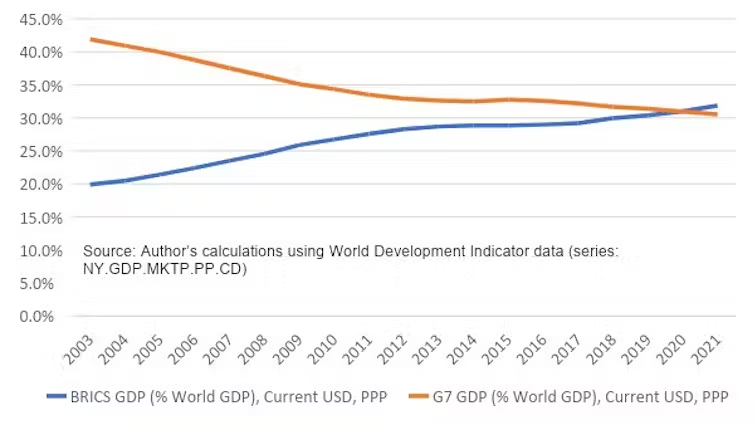

The demand for the dollar provides the USA an ‘exorbitant privilege’ to borrow at favorable rates and balance its current account deficits. However, as outlined earlier, major shifts away from the dollar in the international financial system are starting to operate, reflecting the growing multipolarity of the new world order. The combined GDP of BRICS overtaking that of G7 is a clear indication of this movement.

This begs the question of how the USA plans to respond to these moves made by major competing powers like Russia, China, and the various regional trade blocs that have come up.

Reliance on the dollar rests on the perception of the USA as a safe and stable leader in terms of economy, politics, and military. A 35 trillion dollar national debt, which has increased by 10 trillion dollars since 2020, is certainly affecting the USA’s perception of a stable economy. There is also the perceived stability of its governance which affects global confidence in the dollar. What our question now points to is - does Donald Trump have what it takes to preserve the USA's hegemonic position in the global economy?

Donald Trump has expressed concern about how the dollar is “under siege”. Maintaining dominance of the dollar is a top priority for him, leading him to threaten 100% tariffs for goods of all countries that are moving away from the dollar. He mentioned the inflated energy prices in the American economy during Biden’s tenure - which is heavily linked to de-dollarization. He said he would bolster production of oil by 4-5 times the current production, and attacked Harris’ past positions, saying that her policies would skyrocket oil prices.

Whether Harris or Trump sat in the oval office wouldn’t affect USA’s foreign policy. Both governments would likely have a hawkish stance on China - especially on EV and semiconductor supply chains - and impose high tariffs on imports. Trump’s 1st term saw trade wars between the USA and China, and even Biden’s administration imposed 100% tariffs despite an expected friendlier outlook. This stance would negatively impact the Chinese economy, and consequently affect the European economy more than USA’s, as Europe is more dependent on China. The struggle between the Yen and the Euro should have a bullish effect on dollar dominance.

As for fiscal policy, Donald Trump’s policies are definitely more protectionist than those of Harris. Trump’s policies involve tax cuts for corporations and on social security, and heavy government spending - which adds $5-6 trillion to the national deficit. Fiscal expansion to such an extent would usually not induce worry for the USA’s economic trajectory, but considering its mounting debt and current geopolitical waves, countries and banks would find it problematic to reserve too heavily in the dollar. If Trump were to adopt isolationist policies, FX regionalization and subsequently de-dollarization could definitely amplify.

Trump’s campaign has addressed de-dollarization more openly but also proposed expansive measures that reduce stability. The test for him right now is to tackle the rising forces that are restructuring economic incentives away from the dollar - in turn affecting economic power dynamics among nations. Even though he has explicitly shown more cognizance of major currents against the dollar like energy pricing and localized trade, his protectionist ideology does not promise that it will retain its hegemonic position.

“What should we expect then?”, you may ask. Is it possible for the Chinese currency to transition into an economic hegemon? Or will the global economy become truly multipolar through the emergence of regional blocs? We must remember that all that seems to have started is a movement away from dollar hegemony, not dollar supremacy. Other Great Powers like Russia, India, Germany, and blocs like ASEAN and AfCon also have their own separate vested interests in the global economy. The global economy sits at a complex inflection point right now, with a mixture of protectionist and collaborative currents. However, the overall picture that these currents seem to be painting is that the story of the global economy is definitely evolving to one without a main character.

Comments