Weathering the Storm: The Startup Slump in India

- Om Bharadwaj

- Sep 6, 2023

- 4 min read

Updated: Jul 19, 2024

Edited By: Siya Kohli

Startups Driving Economic Growth: A Brief Introduction

Startups have been said to be catalysts of economic growth. In an economy, startups directly impact job creation, drive innovation and productivity, imbibe a culture of entrepreneurial mindset, and hence overall create an ecosystem of accelerated growth. This idea even resonated with PM Modi when he said "Startups are going to be the backbone of new India". Find out more by reading further about the highs and lows of the startup ecosystem in India and demystify some of the economic nuances that come along with it.

Startup Funding: A Simple Walkthrough

While you will gain insights into a detailed analysis of the startup sector in India based on the funding that they receive through this blogpost, it is important to understand the basics of startup funding. In this section we uncover some of the different financing avenues that a startup might take under consideration. In the early life of any startup, money is required for a variety of reasons, from testing the product-market fit to covering development costs, hiring employees, and renting office/storage spaces (to name a few). These funds can be acquired through methods such as:

Equity financing- giving away a portion of your stake in the company in exchange for funds

Debt Financing- Taking up loans to fulfill the need for funds (from individuals or institutions)

Crowdfunding- large groups of people who contribute money to fulfill financing needs

Government grants - receiving funds from the government trying to boost a particular sector of the economy or innovation in general.

Please refer to this comprehensive list to gain a detailed understanding of startup funding.

A Milestone Year: The 2021 peak

India has the 3rd largest startup ecosystem in the world. With significant growth in the amount of funding received by startups, 2021 became a landmark year. 44 new unicorns were added to the tally that year alone, worth almost 50% of the total number of unicorns then. (source- InvestIndia). Some of the contributors to this were the lockdowns due to Covid-19 inducing mass digitization in South Asian markets. Several companies had to rethink their businesses and leverage the unexpected opportunities that the pandemic brought about. Ed-Tech companies moved to online-based live-class models while similar changes were also seen in other sectors such as health-tech and remote working solutions. These disruptions and emerging innovative solutions were facilitated by large and aggressive investments by hedge funds. The focus was primarily on growth rather than addressing basic components such as positive unit economics leading to the funding of several startups at high valuations. With reduced due diligence times and bullishness towards the Indian startup ecosystem, 10 startups hit the $ 1 billion mark in the first 100 days of the year itself.

This was a peak in the world of startup investing, for India which eventually got off the high in the subsequent years.

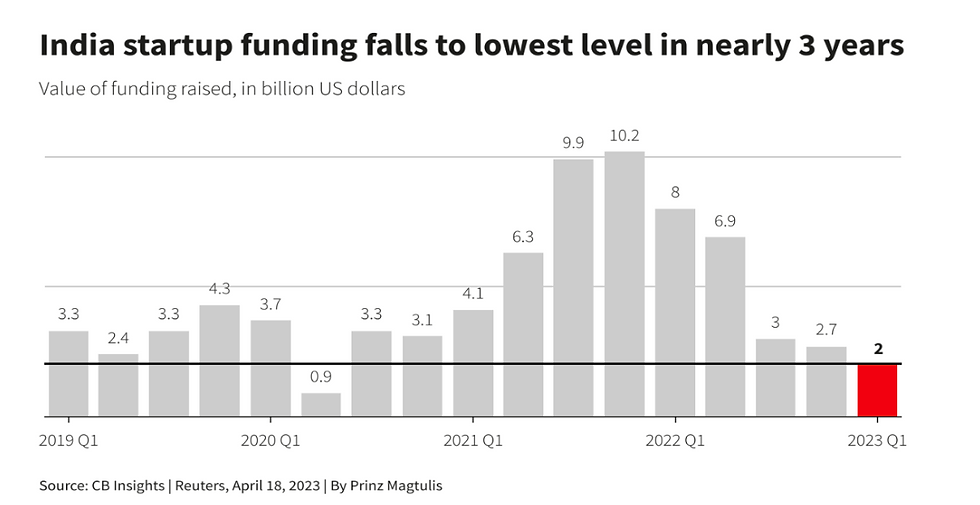

Winter is here: The downfall of startup funding

Several Macroeconomic factors and Geopolitical factors such as the Russia-Ukraine war led to increased market volatility and a subsequent market slowdown in terms of investments. Recessionary forecasts for 2023 have also contributed to this funding winter. Since the beginning of 2022 Indian startups have seen a 73% decline (Comparing funding till November ‘22 and ‘21). India’s dependence on global Private Equity and Venture Capital investments has in turn led the startup ecosystem to be exposed to risks of global investment trends. India’s startup sector was not too far behind the corporate sector in terms of mass layoffs in the face of an economic slowdown. While the economic slowdown may have contributed to the startup slump, there were several internal issues that got exposed during these uncertain times, thereby pushing them to take drastic measures such as mass layoffs. For instance, the heavy cash burn practice to achieve high growth levels, flawed valuation metrics and business models, and high customer acquisition cost,to name a few, finally started to catch up with them by leaving them with very few options to sustain in the market.

This funding winter has also opened up some unexpected opportunities for the startup ecosystem. Several possibilities for smaller startups to obtain market share have opened up, with the decline of their larger counterparts. On the other hand, this scenario has provided a reality check to impacted startups to revisit their business models and practices to better insulate them from global macroeconomic volatilities.

The funding rollercoaster: A new dawn of startup funding?

As the apparent funding winter still continues as per recent reports, there are those who have a different perspective on the current horizon of startup funding. Amitabh Kant while addressing startup20, said that th

ere was no funding winter for good startups and additionally highlighted that there was no shortage of funds for startups with fundamentally solid business models and plans. With the expansive potential of digital technology in India, companies with good corporate governance should not prove to be an obstacle.

With the cyclical nature of markets, I believe that, it may seem like a funding winter for the startup ecosystem of India. Be it due to careful consideration by venture capital funds in terms of startup investments or the slow-down in markets due to other global macroeconomic factors, India’s startup ecosystem positions itself well to weather this storm and has already shown better resilience to these conditions than its global counterparts.

With large merger, acquisition and buyout deals still taking place depicting a possible funding “Autumn” instead of “Winter”, for India, as quoted by Business Insider. While the exact timeline of restoration of investor bullishness on the startup ecosystem of India remains ambiguous, India’s strong startup culture portrays rays of optimism.

Comentários